Our content is funded in part by commercial partnerships, at no extra cost to you and without impact to our editorial impartiality. Click to Learn More

To those less informed, accountancy can seem stale and lifeless. However, new emerging technologies, combined with the growth of remote workforces, are set to herald big changes in the world of small business accounting. In this guide, we explore the latest accounting trends you need to know about and explain why they're important to businesses of all shapes and sizes.

From transformational accounting practices spearheaded by blockchain, to new ways of working in the wake of the pandemic, accountancy is going to see some serious upheaval in 2023 and beyond. Here at Tech.co, though, we don’t just jump on buzzwords and trends – we’ve spoken to leading industry figures and conducted our own independent research, to find out exactly how companies are making changes.

The early 2020s will be remembered by accountants as the time when their jobs truly entered the 21st century, thanks to improved computing operations. It’ll also be looked back on as the time when offices faded into the background, with home offices becoming the center of the accountant’s world. Let's take a look at those accounting trends in more detail.

The Biggest Accounting Trends in 2023

The four main trends our research has identified are the growth of blockchain, advancement of automation, spread of agile accounting and rise of more widespread third-party involvement.

Our survey also revealed some interesting stats on accounting technology and highlighted 11 more accounting trends you should be aware of.

Please note: If you'd like to use any of the graphics in this article on your site, or a summary infographic, you can access these images here. If you do use any, please just credit Tech.co with a link back to this article. Enjoy!

- 59% projected market growth between 2016 and 2024

- $4.1bn worldwide spend on blockchain solutions in 2020

Blockchain is one of the biggest buzzwords in business at the moment. Lots of people claim to be excited about the new tech and its potential, without ever really specifying what that potential is. However, when it comes to accountancy, blockchains could be a serious gamechanger.

That excitement is reflected in the market as well, with more than 55% of businesses saying that blockchain technology is one of their top-five strategic priorities – up from just 43% in 2018. These businesses will all have accounting departments, as well. What’s more, businesses spent more than $4 billion on blockchain solutions in 2020, and the global market for blockchain technology is expected to top $20 billion by 2024 – up from just $315 million in 2015.

What is it?

A blockchain is a digital ledger of transactions that are distributed across an entire network of computer systems. These could be internal networks, private networks, or public networks, as used for cryptocurrencies such as Bitcoin and Ethereum.

Each block on the chain contains a number of transactions that can be viewed and verified by everyone on the network. Whenever a new transaction is added to a block, every participant gets a record of that transaction, as well. In essence, this allows transactions managed on blockchains to be completely transparent.

Currently, banks are getting the most use of blockchain technology, but we’d expect other sectors to catch up quickly.

Why does it work?

Blockchain technologies allow businesses to improve their processes. For example, it will help businesses trust each other when it comes to managing transactions – there’s nowhere to hide from an unpaid invoice if it's on the blockchain.

Similarly, it can also help with record keeping – particularly useful for accountants – because records cannot be forged or tampered with. Plus, each transaction can be verified by multiple different participants on the blockchain.

Blockchain technologies are also super secure. Multiple verifications keep things in order, and each transaction is also recorded with a unique and unchangeable cryptographic signature called a hash.

How should you use it?

Audit smarter

Since it relies on independent verification, blockchain could be used in place of traditional external auditing. Blockchain’s visibility means that inconsistencies will be impossible to hide.

Improve your records

Instead of the old-school double-entry system for record-keeping, blockchain will let you write transactions directly into a joint register that is both secure and publicly accessible.

Verify faster

Writing transactions into standardized joint registers would help auditors work through records faster, allowing them to verify transactions using their unique hash keys.

For accountants, the biggest and most important use of blockchain lies in its ability to store and hold immutable records of transactions. You’ll be able to ensure that any dealings your clients or businesses enact can be recorded and stored on the chain. This will help you keep abreast of what’s going on, as well as make painfully slow auditing a thing of the past.

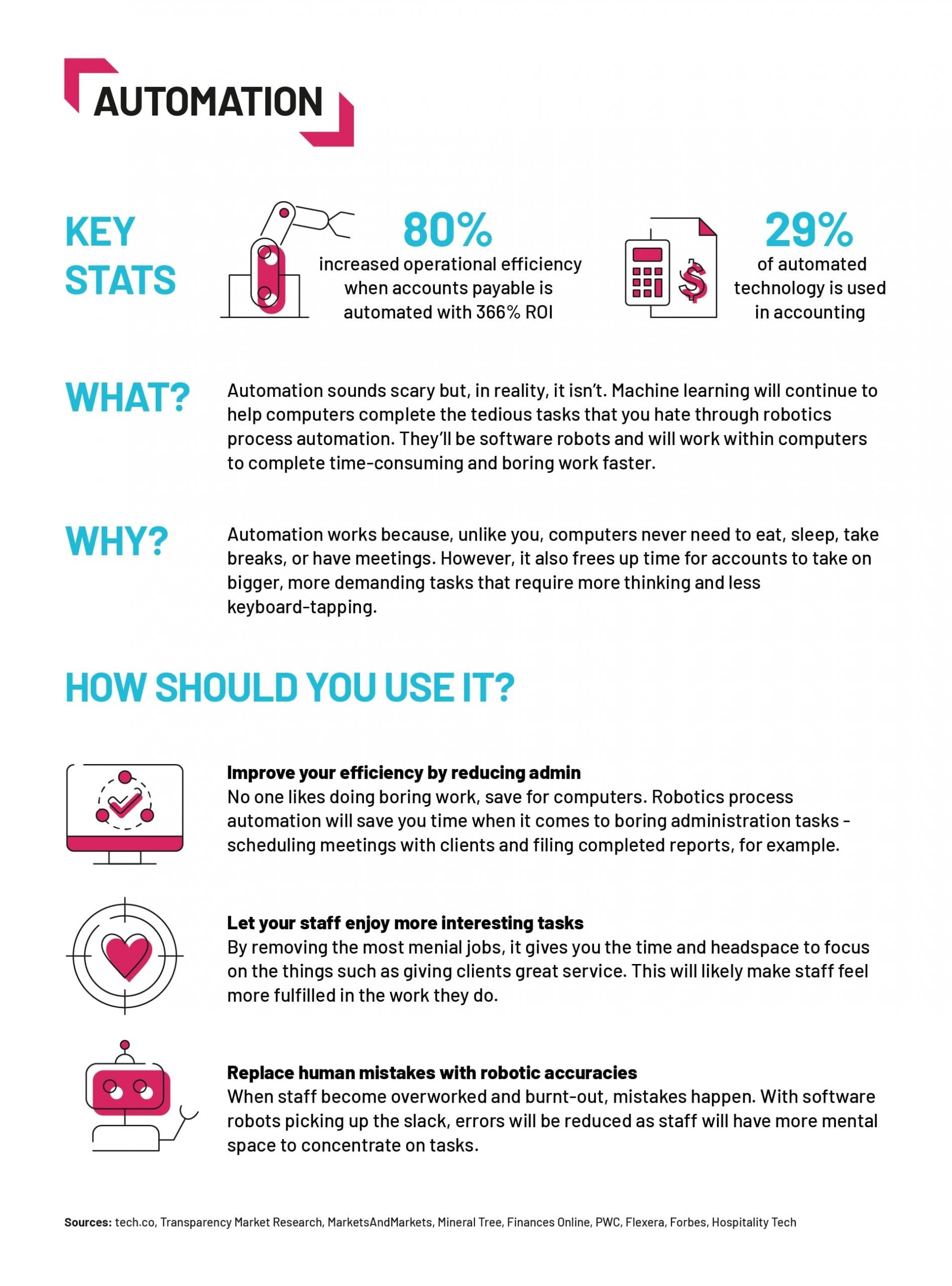

- 80% increased operational efficiency when accounts payable is automated, with a 366% ROI

- 29% of automated technology is used in accounting

Automation sounds scary and gets a lot of bad press. However, the sort of automation you’re likely to come across in the workplace doesn’t consist of robot workers banging away at Excel spreadsheets, typing thousands of words per minute – it’s far less threatening.

In fact, around 29% of high-tech automation is to be found in accounting functions, while 22.8% of businesses are looking to implement some form of automation in the coming years.

What is it?

Accounting automation technology will allow processes or procedures to be completed with minimal human assistance.

Think about filing invoices and scheduling meetings, rather than developing new tax strategies. In many ways, this kind of automation is similar to an Excel Macro tool — the computer can complete a task as long as the rules are defined and it is clear and repeatable.

Why does it work?

Automating the most tedious processes in your work will have two massively important benefits. First, you and the company will be saving time – time that could be used for other more exciting and thought-provoking work. Indeed, 30% of our accounting survey respondents said that the biggest advantage has been the time it has saved.

The second benefit is vastly improved efficiency. You’ll be able to get tasks done faster, reducing the number of long hours you have to spend in the office at financial year-end. In fact, this saved time can help businesses improve efficiency by up to 80%, and can earn a return on investment of up to 366%. Meanwhile, 15% of our respondents highlighted that the use of technology has improved their productivity. And, out of the companies that have automated over a quarter of their accounting functions, a full 70% report either “moderate or substantial ROI.”

However, automation projects can be pretty expensive, making them more suited to bigger companies. They also shouldn’t really be carried out in isolation – automation should be a project for an entire enterprise, not just a lone accountant.

“Artificial intelligence and robotics are reducing operational costs and increasing performance by automating complex and repetitive tasks and procedures with extreme precision,” says Thilo Huellmann, CTO of AI company Levity. “These are some of the new technologies that are assisting today's accountants in transitioning to a more critical thinking role.”

You should be looking to implement these practices cautiously – you won’t be able to automate an entire department overnight, and nor would you want to. Instead, use these tools to reduce the load on your existing staff, and allow them to focus on the most valuable tasks.

3. Agile Accounting

What is it?

An agile working setup is similar but separate from remote working. Agile working means that you’ll be able to work in different locations at different times, while still meeting the demands of the modern workplace.

You might be working at home one day, heading into the office for a critical meeting the next day, before heading to a local cafe the day after. Agile working lets you work around your life, rather than trying to shoehorn your life into your work.

Cloud storage is an essential piece of technology for agile working. “It has been very advantageous to have our accounting system on a cloud,” says Rick Hoskins, founder of Florida business Filter King. “It has allowed me to access data at any time from any location, without needing to bother an employee or wait for office hours. Your accounts are also safer in a cloud, as the risk of theft, loss, or damage are highly reduced.”

Agile working is a great way for businesses to give staff the flexibility they want, while also retaining the ability to function as normal. Staff prefer agile working setups – they feel more trusted, but are still able to form strong relationships with colleagues while also remaining free to move around.

4. Third-Party Involvement

- 49% of consumers downloaded more than two apps during the pandemic for food and drink buying

- 44% of operators planned to upgrade their point of sale system last year

It used to be the case that businesses managed all their own affairs. However, thanks to the rise of digital platforms such as Uber Eats, Square, and Shopify, businesses are outsourcing an increasing number of their business-critical functions.

44% of retail and restaurant businesses, for example, planned to upgrade their restaurant point of sale systems in 2020. What’s more, consumer demand for these services is huge – 85% of consumers have purchased something using a mobile app, while 49% of buyers have downloaded at least two apps during the coronavirus pandemic to buy food and drink.

What is it?

In simple terms, a third-party transaction is a sale or business transaction which involves the buyer, the seller, and another third party. Often, these third parties act almost as middlemen, helping to facilitate the sale or purchase of goods or services.

However, while these roles might traditionally have been fulfilled by insurance brokers, car brokers, or car salespeople, digital technology has seen third-party transactions explode with payment platforms and business aggregator apps.

Why does it work?

Third-party involvement benefits customers because it offers a level of trust that might not be typical of the smaller, independent business they’re looking to buy from. It also makes it far easier for customers to find and interact with businesses.

It benefits accountants, though, because smaller businesses will be able to produce useful information related to sales, profit, and revenue which would exceed their traditional capabilities. Your bookkeepers will be far less stressed, with the apps and platforms doing most of the heavy lifting.

How should you use it?

Through using third-party services, companies gives accountants another source of information about their client’s dealings. More information is always good, and it should make checking transactions easier: Third-party services will keep their own records of transactions, which will help you ensure that all your clients' transactions are properly tracked.

You can also build new systems: Some services offer open APIs, and computer-savvy accountants can connect these to new systems to help track transactions automatically – both improving reliability and saving you time.

Don’t think that these third parties do an accountant’s entire job. There will still be a lot of dedicated work for you, as an accountant, to do in order to make sure your clients meet their obligations. However, it’s also worth recognizing that third parties can also expose businesses to conduct, delivery, and reputation risks – so it’s important not to put all of your eggs in a single basket.

5. Data Security

- $4.45 million is the global average cost for a data breach across 2023 – an average that has grown by 15% over the three previous years.

- Almost one in three (111.7 million) Americans experience a data breach each year.

Data breaches are a rising concern for any enterprise around the globe. A breach is usually financially motivated, meaning that it can be costly: A recent IBM study found that the average data breach around the world in 2023 costs a hefty $4.45 million — and that's just the breaches that are reported.

To combat this growing problem, the accounting industry has increasingly focused on its own data security in recent years. After all, a company's financial data is one of the biggest targets for a bad actor intent on breaching them, and this sensitive data is directly tied to the reports, tax filings, and payroll runs that are often integrated with accounting solutions.

The right security protocols for software may involve two-factor verification and role-based security, as well as extra tools such as password managers and VPNs. But one of the most important measures can't be downloaded: Your business should run employee training sessions on a regular basis to ensure everyone knows how to avoid phishing scams and suspicious links.

6. The New Accountant Role

- The top five job skills employers look for: Effective communication (65%), problem solving (55%), critical thinking (47%), attention to detail (43%), and analytical thinking (41%).

The rise of automations and AI wizardry will have an impact on the skills that accountants need. Now that streamlining tools can handle the boring parts, employees will find the soft skills more important than ever. Developing a high “EQ,” or emotional quotient, refers to a talent for addressing your own (and others) emotions in ways that relieve stress, communicate better, demonstrate real empathy, and ultimately defuse conflict.

Employers are increasingly searching for employees with these skills, and they can be hard to find: 74% of organizations said in a recent poll that it's “more difficult today to attract qualified candidates.” The most frequently cited as missing skills? Effective communication, problem solving, and critical thinking. If your accounting team can do these, they're fitting into the “new” accounting role.

7. Remote Workforce

- 54% of CFOs plan to make remote working a permanent option

- 66% of enterprises already have a central cloud team

Offering remote options has been increasingly popular across the business world, in a shift spurred by Covid pandemic changes. Studies do indicate that remote work makes employees happier and less stressed. Plus, it opens up your hiring options, because it helps your company hire better people from all over the country. You won’t be stuck searching for the same people in the same place.

This kind of change will transform the demands of our offices, our homes, our computer hardware, and the software tools accountants use to complete their tasks.

Remote work isn't everything, however: Recently, some CEOs have been pushing for a return-to-office, while others have regretted pushing too hard for one. And there's no denying that remote workplaces face more cybersecurity concerns, given the sensitive data passing over the internet.

Still, one August 2023 study found that as many as 76% of workers say they would actively start looking for a new position if their employer decided to roll back their existing flexible work options. That's a high level of push-back, and it aligns with similar findings indicating that businesses without any remote work options available are having a harder time hiring.

Ultimately, your business can handle its needs however it chooses. But remote and hybrid workforces are increasingly common, to the extent that your business is impeding its own growth by not allowing for remote work.

8. Artificial Intelligence

Artificial intelligence, or AI, refers to a range of software solutions that go beyond simple automation. They're still designed to complete relatively menial tasks, but the rules don't need to be quite as narrowly defined as they have to be for automations.

AI tools will save you time when it comes to boring accounting admin tasks, such as combing through data for insights, scheduling meetings with clients, or even generating reports. AI can analyze contracts for finance operations, highlighting key data points that can then be reviewed by humans.

You'll boost efficiency while freeing up your staff to enjoy more interesting tasks. By taking care of the most menial jobs, automation gives you the time and headspace to focus on more pressing things, such as giving your company or third-party clients great service. This will likely make staff feel more fulfilled in the work they do. When staff become overworked and burnt out, mistakes happen. With software robots picking up the slack, errors will be reduced, as staff will have more mental space to concentrate on tasks.

You should use accounting AI tools to reduce the amount of time you spend on simple tasks. For example, you can track and approve invoice progress using some accounting software tools. Similarly, you can use it to validate and verify information that you receive from suppliers and other businesses to make sure that everything lines up.

9. Workplace Wellness

“Wellness” can seem like a vague concept, but that's partially because it requires adapting to your employees' unique needs rather than forcing them into a one-size-fits-all approach.

By supporting diverse lifestyles, your company can retain talented staff even when their circumstances change. Childcare, for example, becomes far easier, as do the frequent doctor's appointments needed for many of those impacted by chronic illness or disabilities.

Wellness also involves initiatives designed to make your employees even happier. Perks and flexibility (powered by agile accounting) will make your staff feel happier and more trusted. Wellness support can help staff deal with lifestyle changes – allowing team members to choose flexible working practices if they have kids or other caring responsibilities, for example. This can be a great way to ensure diversity within your company while also maintaining productivity.

Need more inspiration? We've rounded up the top 20 companies known for their premium benefits.

10. Cloud-Based Accounting

- 36% of companies say they aim to begin using cloud-based accounting solutions soon.

- Cloud-based accounting solutions can cut up to 50% of labor costs.

Many of the biggest accounting trends have to do with workplace flexibility and remote options. As companies grow more flexible with their employees, their accounting software must become more flexible to cope. Enter the cloud-based solution.

With all accounting software and data hosted on the cloud, an accountant can access everything they need by simply typing their password in a browser anywhere in the world. They can work from home, in the office, or while visiting their grandparents in Arizona.

Benefits of cloud-based accounting

Greater integration is one advantage of a cloud-based tech stack. Accounting software can work with other key solutions including supply chain management or payroll, all of which can be cloud-based. E-signature and file sharing services can also help more employees operate from the cloud.

Reduced labor costs is another benefit: One study estimates a 50% labor cost savings from those with cloud-based software, in part because it reduces on-premises hardware investments and the IT teams needed to sustain them.

11. More Forensic Accountants

- Industry researcher IBISWorld puts the total amount of forensic accountants at 33,524 employees, with a growth of 2% across 2023.

Forensic accountants are the detectives of accountancy, spending their time looking into company files in search of white collar crimes like employment fraud or identity theft. These crimes are on the rise, and so forensic accountants are more likely than ever to take a look over your own company's books.

Granted, they're only increasing in number by 2% in 2023, but the temptation to commit fraud must be strong in middle management: The culprits behind a full 34% of white collar crimes are middle managers.

To stay clear of forensic accountants working for law enforcement or insurance companies, ensure that anyone working on accounting for your business has oversight from someone else. By establishing a system of accountability, you'll help to nip any potential for insider fraud in the bud.

12. Data Forecasting

Forecasting is a skill that accountants can use to predict the future. This technique depends on a knowledge of how to read historical data, which can be used to inform estimates about future trends in business expenses.

It's a core skill to have in accounting, but it's only growing in importance: Knowing what cash flow, earnings, and consumption rate to expect in the future is even more essential when the future is less defined. With a looming recession, many businesses from Amazon to Meta are citing an “uncertain economy” in their recent belt-tightening decisions.

This makes any data forecasting talent a huge part of an accounting team's successful performance. To keep up with the pack, we recommend brushing up on the skill with the right online courses or initiatives.

13. Tax Policy Updates

Tax laws change every year, and 2023 is no exception. These changes aren't even limited to an annual basis, either: State income tax law changes can take effect during any quarter of the year. As a result, accountants need to ensure they're aware of which new laws may affect their state or the industry in which they operate.

Just as an example, all public US companies at the start of 2023 absorbed a 1% excise tax hike on the fair market value of stock repurchases. Add in the potential for an international law applying to your business, and the potential for a cataclysmic error increases.

Thankfully, there's often a lengthy grace period for corporations to file everything – but that may require more knowledge about how and when to file an extention.

14. Value-Based Pricing

In accounting, it's increasingly important to match your firm's prices with the value that any given customer perceives you'll provide. This is called value-based pricing. Spurred by concerns about a fragile economy, businesses want to be sure that they aren't overpaying.

What are the benefits of settling on a value-based price? This metric ensures that you leave every client feeling as if they've gotten their money's worth. As a result, you'll foster loyalty and increase return customers. It may mean that you don't hike your costs quite as much as you could, but a focus on long-term growth will ultimately pay off far more than a nearsighted focus on the short term.

Additional benefits include greater price certainty and boosted efficiency for all accountants, who can directly tie their work to the price they charge.

15. Outsourcing

- The value of the outsourcing sector is projected to grow by $75.89 trillion between 2023 and 2027

The right offshore staffing solution provider agency can fill needed roles at your business. Outsourcing offers many of the same benefits as third-party involvement, but passes the saved value on to your company rather than simply to your clients. You'll be able to pick out a staffing provider that offers the talent you need, allowing your small team the increased time needed to focus on its core needs.

Reports by ReportLinker and Statista both say that the value of the outsourcing industry could grow as much as $75 trillion between 2023 and 2027. Granted, that applies to far more than just the financial and accounting sector. Still, accounting has been projected to see a potential growth of $56.6 billion between 2020 and 2027, which is enough to confirm that this is a trend worth considering for your own operation.

Benefits of outsourcing include keeping your own headcount low, as well as a greater range of skillsets and tech knowledge than you would otherwise be able to access.

New Accounting Technology

Computers have irrevocably changed workplaces since their very introduction. However, the changes that are set to be introduced thanks to blockchain, automation, the cloud, and third-party providers will signal a new era for accounting.

These new technologies will create a marked improvement for efficiency and productivity, while also offering accountants a better balance between their domestic and work lives.

We surveyed 39 accountants from a variety of industries, who told us how technology has impacted them:

- 97.5% said they have been impacted by accounting technologies

- 75% said it made a positive impact

- 60% believe the future of accounting technology is going to be very positive, whereas 40% believe it will be quite positive.

The biggest positives of the new technology included time saved (30%), better productivity (15%), cloud access (10%), data accuracy (7.5%), and fast data retrieval (7.5%).

However, there were some perceived downsides to the new tech, including training staff (30%), increased cost (10%), bugs in the software (7.5%), fewer accounting positions (5%), and security issues (5%).

Verdict: The Future of Accounting

In 2023 and beyond, accountants are going to meet a lot of new challenges.

Third-party involvement will expose businesses to new risks, but also potentially reduce workloads and lead to more reliable bookkeeping.

Agile work practices could lead to more diverse workplaces, as well as allowing businesses to find better recruits in different locations. However, not all workplaces might feel comfortable with committing to remote working in the long term.

Automation won’t see robots replace accountants, but it will lead to some tedious processes being made things of the past. It will also help accountants spend more time working on more important tasks.

Blockchain technologies offer a huge benefit to accounting firms, with more reliable transactions and greater trust between organizations.

2023 is set to be a big year for accountancy, so make sure you’re ahead of the curve.

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored' table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page