Our content is funded in part by commercial partnerships, at no extra cost to you and without impact to our editorial impartiality. Click to Learn More

QuickBooks Online's pricing starts at just $15 per month for its Simple Start tier, but its costs can run to $200 per month for 25 users on the QuickBooks Advanced plan. Fortunately, QuickBooks Online consistently runs special offers to keep costs low – in fact, you can currently get 50% off your first three months, but you have to forgo QuickBooks' 30-day free trial to claim the deal.

QuickBooks Online's pricing is higher than FreshBooks, but comes with more features, making it the best pick for large or growing businesses. Our accounting software comparison list offers more detail. As another alternative, we'd recommend looking into Zoho Books, which offers a 14-day free trial on its paid plans, as well as a totally free plan for small businesses.

Read on for a breakdown of QuickBooks Online's plans and costs, along with guidance on which package is right for your business. From pros and cons to hidden fees and add-ons, we'll explain everything you need to know about this top-rated accounting software's pricing.

In this guide:

- QuickBooks Online Pricing Plans

- Who Is QuickBooks Best For?

- QuickBooks Additional Fees

- QuickBooks Online vs QuickBooks Desktop

- Integrations & Payment Gateways

- Which QuickBooks Online Pricing Plan Is Right For Me?

- Our Methodology: How We Evaluated QuickBooks as the Best

- Verdict – Is QuickBooks Online Good Value?

| Price | Users | Bookkeeping Does it include bookkeeping functions? | Accounts payable Does it include a range of accounts payable functions? | Accounts receivable Does it include a range of accounts receivable functions? | Project accounting Does it offers tools to track different projects? | Financial reporting Does it offer financial reporting tools? | Budget & forecasting Does it offer budgeting and forecasting tools? | ||

|---|---|---|---|---|---|---|---|---|---|

| Self Employed | Simple Start | Essentials | Plus | Advanced | |||||

| 1 | 1 | 3 | 5 | 25 | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | | |||||

| | | | | |

QuickBooks Online Pricing Plans 2024

QuickBooks Online pricing offers five main plans, plus a host of add-ons for an extra monthly charge.

There are no contracts, monthly and annual payments cost the same, and all plans are available through a 30-day free trial, which is useful for letting potential customers try it out first. QuickBooks is also currently running a special deal: opt out of starting with the free trial, and you can get your first three months half price.

Here are the prices and features for each plan.

- Self-Employed Plan – $20 per month

- best for freelancers

- $10 per month for first three months

- Simple Start Plan – $30 per month

- best for small businesses

- $15 per month for first three months

- Essentials Plan – $60 per month

- best for growing small businesses

- $30 per month for first three months

- Plus Plan – $90 per month

- best for mid-sized businesses

- $45 per month for first three months

- Advanced Plan – $200 per month

- best for enterprises

- $100 per month for first three months

QuickBooks Online Self-Employed plan

First, there's the Self-Employed plan. This is available for just $20 per month and supports a single user.

This plan is designed for freelancers who file a Schedule C IRS form to report their income as sole proprietor.

Key features are the ability to track income and expenses, photograph and organize receipts, estimate quarterly taxes, send invoices, accept payments, create basic reports, and track miles on the mobile app. 61% of freelancers today say their biggest problem is landing clients, so streamlining their process can clear room in their schedule to pursue their next gig.

Features that are not included in the self-employed plan, but are available with the Simple Start plan, include sales and sales tax tracking, 1099 contractor management, and the ability to create and send estimates.

The Self-Employed plan comes with two additional bundles on top of the original plan:

- Self-Employed Tax Bundle: For $30 per month, you'll get the Self-Employed plan, plus the functionalities to pay quarterly estimated taxes directly through QuickBooks and to transfer data to Turbo Tax.

- Self-Employed Live Tax Bundle: For $40 per month, you'll get the Self-Employed Tax Bundle, plus “unlimited” access to a CPA.

See how QuickBooks compares to a key rival in our QuickBooks vs FreshBooks head to head guide

The QuickBooks software interface is easy to use.

QuickBooks Online Simple Start plan

The QuickBooks Simple Start plan costs $30 per month and supports one user. As part of a special deal, the first three months will only cost you $15 per month, provided you skip the free trial.

This plan is best for small businesses, whether an LLC run by just one individual or a simple partnership. It'll help someone keep their accounting data in one place, although it doesn't offer many bells and whistles that could be useful for a larger operation.

Simple Starts includes all the features from the Self-employed Plan but adds a range of helpful additions covering everything from basic bookkeeping to budgeting.

For example, you can start recording fixed assets. You can also create a supplier database and generate purchase orders to help manage your accounts payable.

Similarly, you can create a client database and track overdue client payments to keep on top of who owes you what.

Finally, you can start creating budgets and cash flow projections based on your client and supplier information.

You can create an unlimited number of invoices and estimates, as well as tracking your expenses, managing business contacts — you can also manage up to 1,099 contractors. You can bring live bank feeds into your account and access a range of third-party integrations.

Reporting tools are available on the Simple Start plan but they are a bit limited. Vehicle tracking is included, too, should you need to invoice for fuel and driving time for any job.

What's New: As of our December 2023 update, QuickBooks has added a “bookkeeping automation” tool across all plans, including Simple Start. This feature auto-sorts expenses into the right business category for tax purposes, and lets you set up rules to categorize recurring transations.

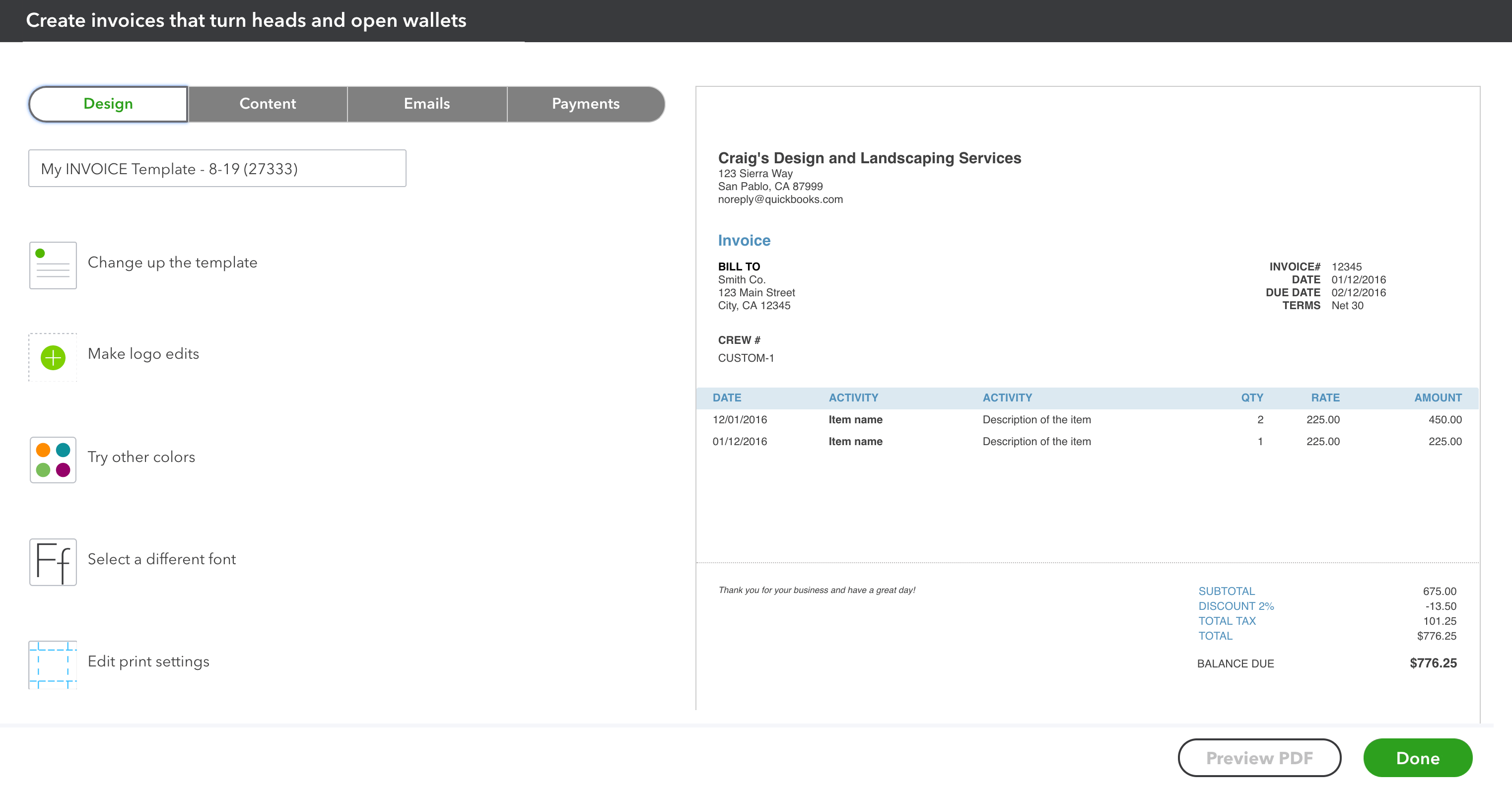

QuickBooks Essentials expands access to expense management tools.

QuickBooks Online Essentials plan

The Essentials plan costs $60 per month, supports three users, and brings a range of accounts payable functions to small businesses compared to the Simple Start plan. If you take part in the deal and skip the free plan, the first three months will only cost you $30 per month. These prices rose slightly back in early-2023, when this plan cost just $55 per month.

The Essentials plan is a great fit for growing small businesses that have an increased number of suppliers, employees, and clients.

You'll be able to track bills, set up recurring billing, track expenses, record payments in multiple currencies, and scan bills to keep abreast of all the money your company is owed.

Time tracking is another new feature this plan offers. With it, users can track their billable hours, categorizing them under the correct client and employee, while automatically adding them to invoices. These hours can be added by the manager manually, though the employee in question can also be given permission to add their hours themselves.

Invoicing templates can be created and re-used with QuickBooks software.

QuickBooks Online Plus plan

The QuickBooks Plus plan costs $90 per month, supports five users, and includes several advanced features compared to the Essentials plan. If the three-month deal is applied, this price is dropped to $45 per month. As with Essentials, Plus prices rose by $5 a month in 2023, when it cost $85 per month.

The Plus plan is best for mid-sized businesses that need to manage the complexities of billable hours across a raft of clients, as well as any businesses with an inventory of products or a growing number of ongoing projects that would be tough to manage otherwise.

The ability to track project profitability is another big benefit to this plan: A project management feature gives users a single location to view all projects, letting them see any given project's labor costs, payroll, and expenses, in order to efficiently track project profitability and generate reports.

Under the Plus plan, products and the cost of goods can also be managed, with automatic notifications signaling when certain inventory is low and needs to be reordered. Product data can be imported from Excel or synced with Amazon, Shopify, Etsy, and other platforms.

Tracking project profitability through QuickBooks software.

QuickBooks Online Advanced plan

The QuickBooks Advanced plan offers the most features for the highest cost: It's $200 per month, supporting 25 users. The special deal drops this to $100 per month for the first three months.

QuickBooks Advanced is best for enterprise businesses with support for extra users and the new features which help businesses operate more efficiently at scale.

For example, it brings a dedicated account manager, priority customer support, customer user permissions, and online training courses.

It also supports batch importing, to help a single user create, edit, and send multiple invoices, checks, expenses, or bills. You can also automate key accounting tasks such as setting reminders for invoices, payments, or deposits. You can automatically notify customers when their payments have been received and you can route invoices through pre-set approval flows.

You can track KPIs with in-depth analysis tools, consolidate data from multiple companies into singular reports, and compare different companies, clients, or franchises. You also get access to exclusive premium apps such as LeanLaw, HubSpot, DocuSign, Bill.com, Salesforce, and more.

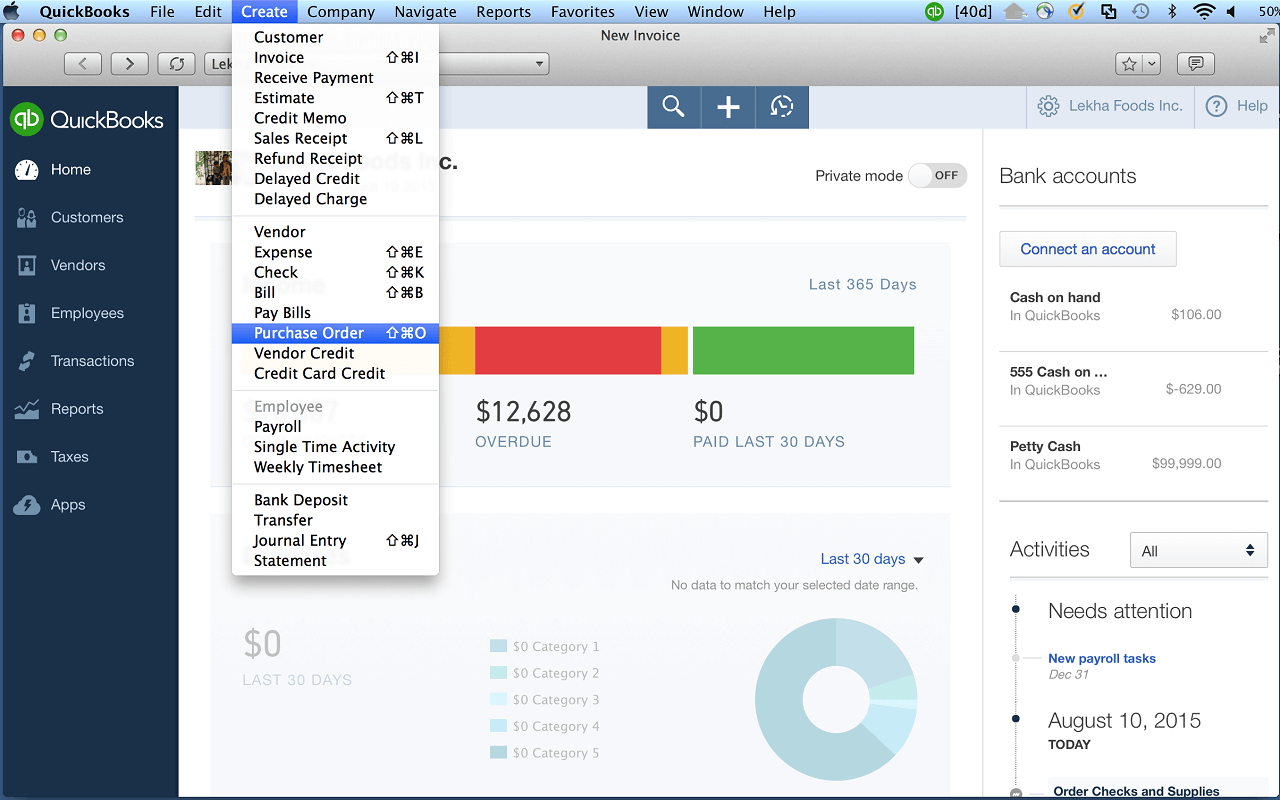

The QuickBooks software offers dropdown menus for easy access to its many tools.

Who Is QuickBooks Best For?

QuickBooks Online has a large potential customer base. Our researchers ranked it the highest overall with a research score of 4.7 points out of 5, meaning that it's the top pick for the average business, small or large.

If you need a rock-solid, feature-packed accounting solution at a fair price, QuickBooks is the best. But other accounting tools come with slightly different strengths, so read our complete guide to the best small business accounting software to see if another option is best for your unique needs.

QuickBooks Online Additional Fees and Features

That's not all, folks: QuickBooks offers a host of useful add-ons for an extra monthly charge. First, there's payroll processing, a function that's hugely useful for a business with more than a few employees, but one that's rarely included in an accounting software service's main offering.

QuickBooks Payroll

QuickBooks Payroll pricing comes in three plans — Core, Premium, and Elite — with each offering more features than the previous one. Here are their features and standalone prices:

- Core – $75 per month, plus $5 per employee, per month. This plan does the basics: It automatically runs payroll, files payroll taxes, and offers employee services like health benefits and workers' comp.

- Premium – $160 per month, plus $8 per employee, per month. This plan adds role-based access, same-day direct deposit, and automatic time tracking for more granular, yet still automated control over paychecks.

- Elite – $125 per month, plus $10 per employee, per month. This plan includes tax penalty protection, and a professional to offer hands-on help with setting up and troubleshooting.

The plans can be upgraded at any time, so if you're in doubt, start with Core and see if it works for your payroll needs.

Core can also be packaged with either the Simple Start accounting plan for $75 plus $5 per employee, per month, or the Essentials plans for $100 plus $5 per employee, per month.

The QuickBooks Payroll software tracks employees by name, pay rate, pay method, and current status.

QuickBooks Live Bookkeeping

Paying for software doesn't fully keep your accounting on track: You'll still need to know how to use QuickBooks properly in order to get the most out of it. The QuickBooks Live Bookkeeping service solves this issue by connecting businesses with a live, certified expert to keep their books in order. The expert will categorize transactions, reconcile accounts, create reports including an income statement and balance sheet, and close the books every month.

The custom price varies depending on the size of your business but should be somewhere between $200 and $600 per month.

QuickBooks Setup Fee

Worried about setting up your QuickBooks account? For just $50, QuickBooks Live Bookkeeping will set you up with an expert for one session.

Setting up the software involves plenty of one-time tasks that you'll want to get right the first time, like connecting your bank account and setting up a series of automated processes and templates. Through Live Bookkeeping, you'll get a single one-on-one session that can clear up any questions and start your accounting software subscription off on the right foot.

QuickBooks Capital

Also available from the service is a lending program called QuickBooks Capital. Those with QuickBooks Online accounts are potentially eligible, though they'll still need to qualify on the strength of their accounting history.

Tax Forms & Support

QuickBooks sells tax forms directly to its users for an extra cost that will vary depending on which state your business is located within. They also sell some as kits, which come with the correct envelopes too. Here's which forms you'll likely need:

- W-2 kits

- 1099 kits

- W-3

- 1096

QuickBooks has also stopped allowing users to file their sales taxes online through the service. You'll now need to file business taxes manually, and update your QuickBooks account with the information afterward.

Some Payroll plans include printed forms at no additional cost. The Premium and Elite plans also support automatic filings for state new hire paperwork.

Checks

QuickBooks also sells physical checks. You can buy:

- Standard checks – Starting at $60.98 for 50

- Wallet Checks – Starting at $47.07 for 50

- Manual Checks – Starting at $70.79 for 300

- Secure Plus Personal Checks – Starting at $42.79 for 120

- Voucher Checks – Starting at $71.68 for 50

- Office and Away Checks – Starting at $113.74 for 250

Are they worth getting? Well, they're far pricier than many other vendors selling similar checks, so likely not.

However, the “Secure” brand of checks offer in-depth fraud protection measures that may justify the price, provided you anticipate security risks at your business.

QuickBooks sells branded paper checks.

QuickBooks Online Pricing vs. Competitor Pricing

QuickBooks Online isn't perfect for every business, but how does its pricing compare to the costs charged by its competitors?

FreshBooks' pricing starts at $17 per month, so it costs a little less than QuickBooks' $20-per-month plan. FreshBooks stands out for a great set of features, but it does not offer the payroll processing or advanced tools that QuickBooks has.

Zoho Books is a top choice for small and growing businesses. Zoho Books has a free plan, while QuickBooks does not, and both Zoho Books and QuickBooks offer a large range of features on their higher-priced plans. However, Zoho Books plans (after the free one) tend to be equal to or more expensive than comparable QuickBooks plans: Zoho's popular plans cost $15, $40, and $60 per month, compared to QuickBook's $20, $30, and $60 per month costs.

Some of Xero's plans cost less than QuickBooks' plans, but most do not. Xero's plans cost $13, $37, and $70 per month, compared to the QuickBooks $20, $30, and $60 per month plans.

If you're trying to decide between two of these specifically, check out our direction comparison guides, like Zoho Books vs. QuickBooks.

Before we dive into the details of each QuickBooks plan and its value, here's a look at the latest accounting software deals and discounts from the biggest and best QuickBooks alternatives on the market.

| Price from | Free trial | Core Benefit | Deal | |||||

|---|---|---|---|---|---|---|---|---|

| FEATURED DEAL | ||||||||

| FreshBooks | Zoho Books | QuickBooks | Xero | Sage | Wave Financial | Kashoo | GoDaddy Online Bookkeeping | OneUp |

|

|

|

| $4.99/month | $9/month | ||||

| | | | | | It's free, no trial needed | | | |

| Great features; a simple, slick interface; and a competitively low price | Strong automation features | A broad range of accounting features, professional look and feel, helpful and free trial period | Online integrations | Very user-friendly | Tracks money owed at a low cost | Easiest setup | Very cheap | Strong CRM features |

| 60% off for six months on all plans | No active deals | Save 50% for three months | No active deals | Save 70% for six months | No active deals | No active deals | No active deals | No active deals |

QuickBooks Online vs QuickBooks Desktop

At the most basic level, QuickBooks Online is the cloud-based version of QuickBooks. All your data is stored in QuickBooks' cloud and you'll be able to access it anywhere on any device. QuickBooks Desktop, on the other hand, is locally installed with a license pricing model.

However, there are a serious of other changes which are worth considering. For instance, with QuickBooks Online, your security is handled by QuickBooks. However, as QuickBooks Desktop is locally installed, you'll be responsible for your own data security.

QuickBooks Online has a monthly pricing structure — you pick the right plan and then pay every month for the service. QuickBooks Desktop, however, has a three-year license, or you can pay for yearly updates.

QuickBooks Online allows up to 25 users on its most expensive plans. However, the QuickBooks Desktop Pro requires you to pay $299 for every additional user, up to a maximum of three. Desktop Premier and Enterprise, meanwhile, allow up to five and 30 users, respectively.

QuickBooks Online also offers more automation features, which might be a better fit for small businesses — the more tasks you can delegate to the software, the more efficient your business will be. QuickBooks Desktop also has a more dated and harder-to-navigate UI than QuickBooks Online.

QuickBooks Online Integrations & Payment Gateways

Any sized business has paperwork, even just a single freelancer. But with the right accounting or invoicing software for small businesses, filing tax information can be a simple and streamlined process. QuickBooks makes this process even easier thanks to a huge range of integrations and plug-ins you can use, with familiar names such as PayPal, Shopify and MailChimp all present and accounted for.

QuickBooks Online Integrations

QuickBooks' range of over 650 integrations will help you connect your account to useful third-party apps and services. Perhaps you've already used some, like Google's G Suite or Microsoft's 365, or perhaps you just need to be able to accomplish something that QuickBooks doesn't support. Whatever the case, the right integration will make your business operations even more streamlined.

Here's a quick, non-exhaustive list of the most popular QuickBooks Online integrations, how they work, and how much they cost:

- PayPal — free — import PayPal sales, fees, taxes, tips, discounts into QuickBooks as well as generating sales receipts.

- Square — free — import transactions into QuickBooks, review transactions, support multiple locations.

- Shopify — starting at $30 — automatically bring your sales data into QuickBooks.

- TSheets (now QuickBooks Time) — starting at $8 per user per month plus $20 per month base fee — access accurate employee time tracking for easy payroll.

- Fathom — starting at $44 per month — adds extra analysis tools and metrics to see how your business is performing.

- Gusto — starting at $40 per month plus $6 per month, per employee — payroll automation tool with automatic federal, state, and local tax filings.

- MailChimp — $7.99 — automatically updates new and changed customer records from your QuickBooks records.

- Housecall Pro — starting at $49 per month — allows you to easily keep track of jobs and customers with scheduling, dispatch, CRM, and automatic estimates and invoices.

QuickBooks has over 650 third-party integrations.

QuickBooks Online Payment Gateways

QuickBooks also offers connections to a variety of online payment processing services. PayPal and Square are included, as our integrations section above touches on, while Stripe and Authorize.Net are two more potential payment services.

In total, QuickBooks Online support around 25 payment processors. If you'd prefer to keep it in-house, there's QuickBooks Payments, which supports a variety of payment mediums, each with a different transaction fee:

- 1% charge for ACH transfers, up to a maximum of $10

- 2.4% + $0.25 for swiped cards

- 2.9% + $0.25 for invoices

- 3.4% + $0.25 for keyed-in cards

Supported credit cards include Mastercard, Visa, American Express, Discover, and Apple Pay.

Which QuickBooks Online Pricing Plan Is Right For Me?

Your business size and structure will determine which QuickBooks Online plan is best. If you're a single freelancer, you won't need to manage any other employees, and you won't need to track many sales (if any) – so the Self-Employed Plan is best for you. We've ranked the best self-employed accounting software, and QuickBooks is at the top.

If you're a small business looking for accounting software, you might want the Simple Start Plan, which allows you to create and manage invoices, estimates, bills, and sales taxes.

Once your business is large enough to require more automation and more employees, the Plus Plan likely makes sense, as it allows for recurring payments in addition to time tracking. It also includes inventory tracking, making it a must for an operation that sells more than a few products. Due in part to these reasons, QuickBooks is our pick for the best hospitality accounting software.

Finally, there's the QuickBooks Advanced plan. This option is best for large businesses that could benefit from the extra support features, like a dedicated manager or virtual training classes.

Our Methodology: How We Evaluated QuickBooks Online Pricing

In order to accurately compare top accounting software, the Tech.co research team picked out the eight core categories to divide their efforts along, from help and support to accounts payable tools.

But for this guide, one of those categories was deemed the most important: “Pricing Factors,” the research category that covers price plans and the features included with each, as well as free trials or demos, deals, add-ons, and hidden costs. By comparing plan costs with the number and quality of features they provide, our team could determine whether the ratio of features to price made the plan a good deal or not.

Our team ranked all the best accounting solutions using a points-system for each category. Once they were done, they compiled all category scores for each brand into a single 5-point score. This allows us to rank each software in comparison to the rest while tracking each and every feature. Once the dust had cleared, the winner was QuickBooks with a top score of 4.7 points overall.

Verdict – Is QuickBooks Online a Good Value?

Yes, QuickBooks Online offers good value for its price across all plans. Granted, the right plan for you will vary depending on your needs, and there are alternative accounting software options on the market that may also be a good fit. Still, QuickBooks Online offers an unbeatable range of features, packaged in a solid interface with good support.

If you're ready to try it out, all QuickBooks Online pricing plans are available for a 30-day trial or 50% the first three months. If you want to check out the competition first, try our experts' online comparison page:

If you click on, sign up to a service through, or make a purchase through the links on our site, or use our quotes tool to receive custom pricing for your business needs, we may earn a referral fee from the supplier(s) of the technology you’re interested in. This helps Tech.co to provide free information and reviews, and carries no additional cost to you. Most importantly, it doesn’t affect our editorial impartiality. Ratings and rankings on Tech.co cannot be bought. Our reviews are based on objective research analysis. Rare exceptions to this will be marked clearly as a ‘sponsored' table column, or explained by a full advertising disclosure on the page, in place of this one. Click to return to top of page